Excess inventory is a well-known and often visible issue within many organizations. If you are reading this, it is likely because you are already aware of the problem, and so is everyone else in your business.

Consider the analogy of a financial audit. When discrepancies appear in the accounts, they signal that something is not functioning as it should. The numbers do not align, and the implications can be serious. Just as financial irregularities can disrupt strategic planning and decision-making, excess stock can slow down operational efficiency and tie up valuable resources.

Your inventory is a core asset, much like your financial records. When it is mismanaged or allowed to pile up unnecessarily, the consequences can ripple through procurement, warehousing, and cash flow. The first step toward resolution is recognition. Ignoring the signs shall only allow the problem to escalate. By the time action is taken, the cost of depreciated assets may be significantly higher.

This principle applies to excess stock. Addressing it proactively is essential to maintaining operational health and financial agility.

Also referred to as overstock or surplus inventory, excess stock represents the portion of goods held in inventory that is not expected to be sold in the foreseeable future or has been in storage for a large amount of time. 'Large’ depends on the sort of goods and the stage of the lifecycle it is in.

It is important to distinguish excess stock from strategically held inventory such as safety stock, buffer stock, or seasonal reserves. These types of inventories serve specific operational purposes and should not be classified as overstock or excess.

It is important not to overlook the wider implications of excess inventory. Surplus stock affects every area of the business from operations and finance to sales and supply chain management. Every department, and ultimately every employee, feels the strain.

While some instances of excess stock may be small and easily resolved, others can have significant consequences. Decreased cashflow or capital makes it harder to invest in newer stocks. These more serious cases can impair short-term performance and make long-term growth impossible.

Each excess stock issue typically presents multiple risks. At a minimum, it can impact your business in three distinct ways: operational efficiency, financial performance, and strategic agility. If you ignore these challenges, it can compound and result in substantial losses.

There are a couple of clear indicators which indicate the chance of overstock problems

Tips for Effective Overstock Clearance

To ensure a responsible and successful clearance of overstock inventory, buyers and retailers should consider the following best practices:

Engage Early with Trustees: Establish communication with bankruptcy trustees as soon as possible to understand legal boundaries and expectations.

Respect Brand Guidelines: Ensure that resale strategies align with the brand’s image and long-term positioning.

Segment Inventory Strategically: Categorize products based on value, seasonality, and brand sensitivity to determine appropriate resale channels.

Avoid Mass Dumping: Refrain from selling large volumes to outlets or discount chains that could harm brand perception.

Use Trusted Distribution Partners: Work with vetted resellers who understand the importance of brand integrity.

Consider International Markets: Exporting to regions where the brand has less visibility can reduce reputational risks.

Maintain Transparency: Keep stakeholders informed about the clearance process to build trust and avoid legal or reputational issues.

Document Everything: Maintain clear records of transactions, agreements, and resale conditions to ensure accountability.

1. Warehouse Congestion and Space Constraints

An increase in inventory volume often leads to physical overcrowding in the warehouse. This can quickly result in space shortages, disrupting daily operations and reducing overall efficiency.

In many organizations, excess stock is immediately visible. It may be the first thing employees encounter upon arrival, signaling that inventory levels have exceeded storage capacity. In such cases, the warehouse is simply not equipped to accommodate the surplus, and the stock remains dead.

This issue is frequently neglected. Over time, the presence of excess stock becomes normalized, and procurement teams may no longer recognize it as an issue. As a result, corrective action is delayed.

In severe cases, businesses may be forced to invest in external storage solutions or expand their facilities, incurring additional costs. Furthermore, warehouse workflows become cluttered and inefficient, affecting productivity and employee morale.

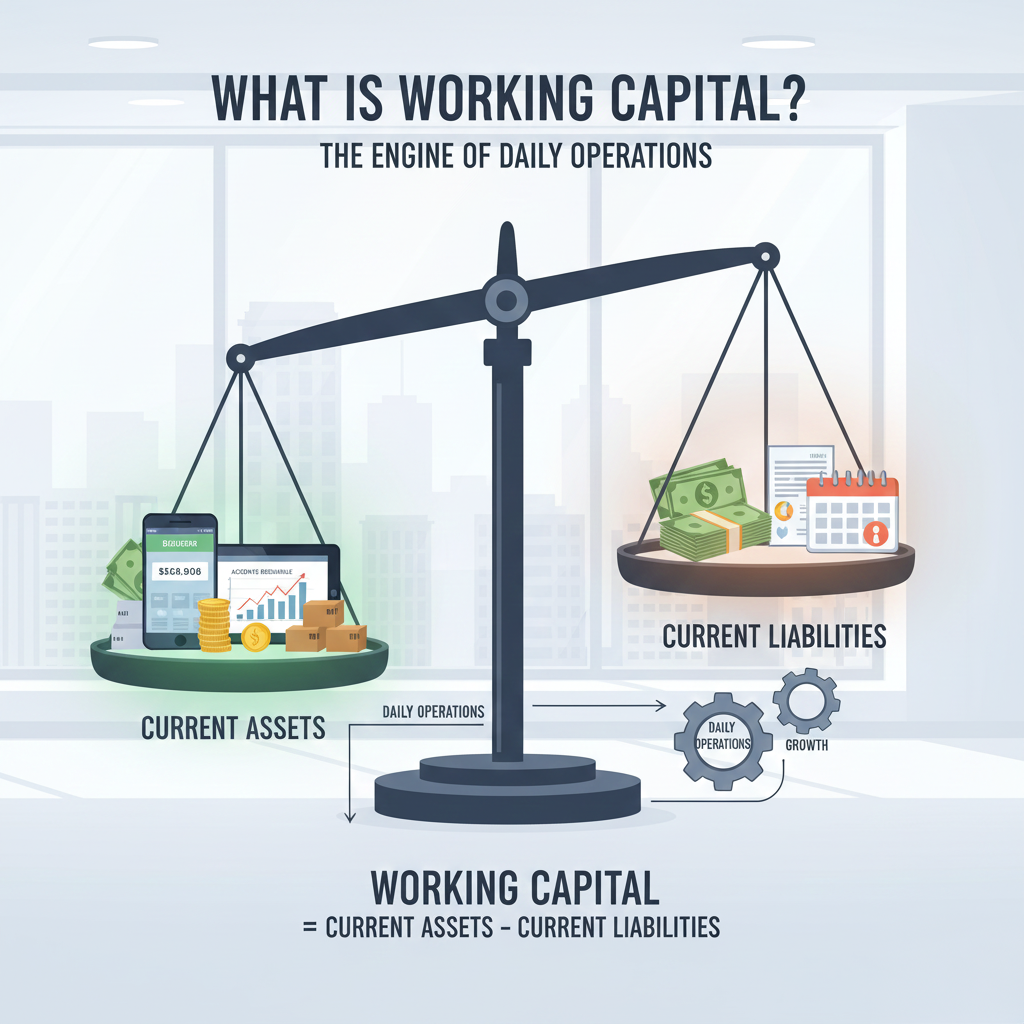

2. Pressure on Working Capital

The financial impact of excess inventory is most severelyfelt by the finance department. Surplus stock increases inventory value on the balance sheet, which can negatively affect key performance indicators related to capital efficiency.

This strain on working capital may push the business into a liquidity risk position. Financial managers evaluate liquidity by determining the extent to which available cash and receivables can cover the company’s short-term obligations. When too much capital is tied up in unsold inventory, the business may become illiquid and more reliant on external financing.

If excess inventory begins to compromise liquidity, finance leaders typically advise reducing inventory right away to improve finances and lower debt risk.

3. Operational Disruption and Reactive Overstock Management

Excess inventory often forces businesses into a reactive mode of overstock management, rather than enabling a strategic and data-driven approach. Inventory managers may notice a decline in performance metrics such as Inventory Value relative to Stock Turnover, indicating inefficiencies in how stock is being utilized.

Inventory planners, meanwhile, face a growing number of overstock exceptions, increasing the complexity of their daily workload and reducing their capacity for proactive planning.

By the time operations reach this stage, it is often too late to conduct a thorough inventory analysis to identify which items should be reduced. Effective overstock management is not simply about lowering inventory levels but it is about ensuring the right products are available in the right quantities, at the right locations, and at the right time!

Uncoordinated stock reductions that are not aligned with a broader inventory strategy may deliver short-term improvements in stock levels. However, without proper planning, these actions can lead to stock-outs, disrupting order fulfillment and negatively impacting customer service.

Understanding the symptoms of excess inventory is essential, but identifying the root causes is equally critical for effective overstock management. While there are many contributing factors, the following are among the most common issues encountered by inventory consultants across industries:

1. Inaccurate Demand Forecasting

Many businesses struggle with forecasting due to the complexity and diversity of their product portfolios. Common challenges include:

Fast changing or irregular demand patterns

Slow-moving items with unpredictable turnover

Frequent product changes and adjustments

These factors require tailored forecasting and inventory models to maintain accuracy. As products evolve through their life cycles, historical demand data must be leveraged appropriately. Unfortunately, many organizations rely on spreadsheets or outdated systems that simply aren’t equipped to handle this level of complexity.

2. Supply Chain Complexity

In single-site operations, inventory requirements are relatively straightforward. However, in multi-site or multi-echelon supply chains, visibility and control become more difficult. Even if stock levels are optimized at individual locations, the cumulative effect across the network can result in significant overstock.

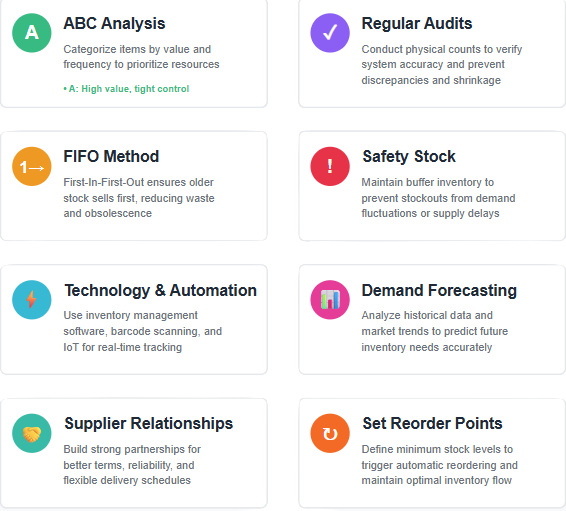

3. Mismanagement of Safety Stock

Safety stock levels that are reviewed infrequently, only once or twice a year, may become inflated relative to actual demand. This results in unnecessary inventory snowballing and increased holding costs. Regular review and dynamic adjustment of safety stock are essential for effective overstock management.

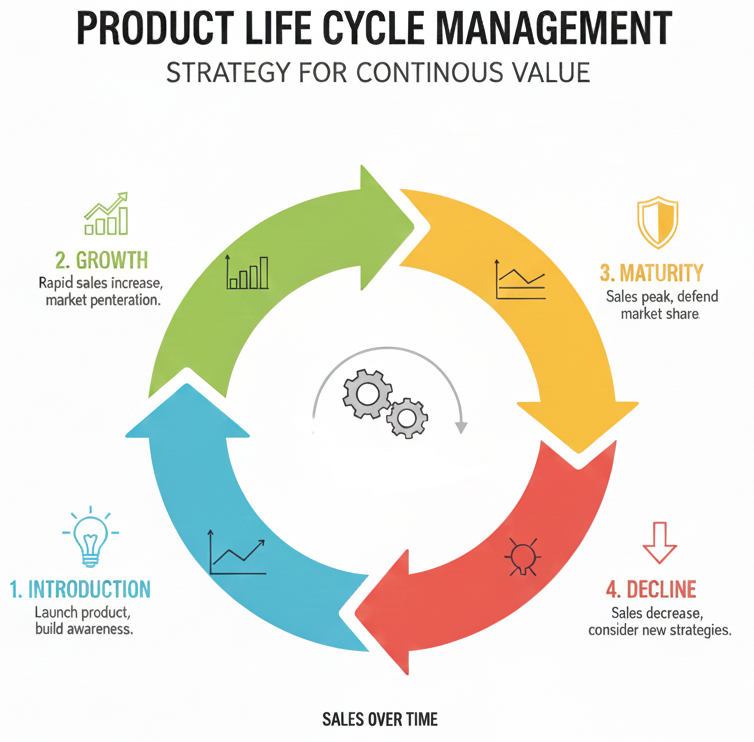

4. Poor Product Life Cycle Management

Every product follows a life cycle: introduction, growth, maturity, and decline, also known as the End Of LIfe (EOL). If inventory levels are not adjusted during the decline phase, excess stock is inevitable. Without proper overstock management, businesses risk significant financial losses and operational inefficiency.

5. Unexpected Obsolescence

Market trends can shift rapidly, making certain products outdated without warning. When forecasts fail to anticipate these changes, surplus inventory accumulates. Excess stock not only occupies valuable warehouse space but also ties up capital and increases the risk of total write-offs.

Overcoming Excess Inventory: Strategic Recovery

Once excess inventory has accumulated, the challenge becomes how to address it effectively. While drastic measures such as scrapping may seem like a quick solution, they are rarely advisable and less profitable

Writing off obsolete inventory is often necessary, but it comes at a cost. Accepting that certain items no longer hold value, or worse, carry a negative value due to ongoing holding costs, can be difficult. This decision impacts margins and is unlikely to be well received by management.

It is important to recognize that the original investment in these items has already been lost. Continuing to store them only compounds the financial impact. This is a classic example of the sunk cost fallacy: the belief that past investments justify continued commitment. In reality, removing obsolete stock is often the most cost-effective course of action.

Luckily, there are proven strategies to recover from excess inventory and strengthen your overstock management practices. Effective overstock management requires discipline, strategic alignment, and a willingness to make difficult decisions. Success depends not only on external tools and processes, but also on internal commitment and leadership with though decisions

Accountability in Overstock Management

When excess inventory becomes a recurring issue, it may be easy to assign blame to one person. However, fostering a culture of accountability and continuous improvement is far more productive than pointing fingers. Time and resources are better spent identifying root causes and implementing effective solutions.

Understanding how the situation developed is essential to preventing it from happening again. Overstock is rarely the result of a single decision or department. It is often a consequence of multiple factors across the organization.

While the supply chain team may be responsible for purchasing decisions, other departments also play a role. Finance may have missed early warning signs, planning may have relied on inaccurate forecasts, and executive leadership may have set service level targets or sourcing strategies that contributed to the issue.

Ultimately, responsibility for overstock management lies with leadership and proper forecasting. Management determines product stocking policies, sourcing approaches, and inventory performance targets. These are all critical drivers of inventory outcomes.

Rather than focusing on blame, the priority should be to establish clear ownership, improve cross-functional collaboration, and implement robust overstock management. By doing so, organizations can reduce the risk of excess stock and transform wasted inventory into new revenue.

8 Steps to Painlessly Remove Excess Stock

Effectively managing and reducing excess inventory and overstock requires a structured approach. Below are eight practical steps to help you regain control of your stock levels and strengthen your overstock management strategy.

Step 1: Quantify the Problem

Inventory value is often the first indicator of an excess stock issue. A sudden increase should call for immediate attention. However, focusing solely on total inventory value can be misleading. Without segmenting the data, it is difficult to distinguish between problematic stock and strategic reserves.

Many organizations lack visibility into how much of their inventory is truly too much. To better understand this, you should start asking the following questions:

Is the surplus tied to fast-moving products that will resolve naturally?

Or is it concentrated in slow-moving or stagnant items?

Inventory value without context is insufficient. To properly assess the situation, perform targeted analyses such as:

Inventory Value vs. Stock Turnover

Inventory Value by Product Life Cycle Phase

Inventory Value by Product Group or Classification

Stock Days (average days inventory is held)

These metrics will provide a clearer picture of the scale and nature of the excess stock, enabling more informed decision-making.

Step 2: Define Strategic Priorities

Once you have identified which stock represents a genuine problem and which may still hold potential, the next step is to prioritize based on business impact.

Focus should be placed on high-value, high-impact products. This prioritization is typically guided by service level targets, which reflect the time, capital, and space allocated to specific items. These targets are set by management and should align with the strategic importance of each product.

To determine which products are most critical, go beyond simple sales volume. Instead, evaluate:

Revenue per SKU

Margin contribution per SKU

Number of customers per SKU

Order frequency per SKU

Profit percentage per SKU

This analysis will help you understand the true value of each item in your portfolio and ensure that inventory decisions are aligned with business objectives.

Step 3: Regularly Review and Refine Service Levels

Addressing excess stock is not only about resolving the current issue and focuses on preventing it from happening again. One of the most effective ways to achieve this is by establishing a routine evaluation of your service level targets.

Service levels are a critical component of inventory strategy, yet they are often difficult to measure accurately. This complexity, however, should not be a reason to overlook them. On the contrary, it highlights the need for closer attention.

If your supply chain costs are rising, customer satisfaction is declining, or your business objectives have shifted, it is a clear signal that your service levels may need to be reassessed. But rather than waiting for these symptoms to appear, a proactive approach and routine analysis are key.

By continuously evaluating service level performance, you can ensure that inventory investments remain aligned with business priorities, customer expectations, and operational capacity. This discipline not only supports better overstock management but also strengthens your ability to respond to change with agility and confidence.

Step 4: Reassess Your Stocking Strategy

A common root cause of excess inventory is a misaligned stocking strategy. In many organizations, stocking decisions lack a structured framework, resulting in inconsistent logic, gut-feeling approaches and misplaced investments across the product portfolio.

Without a clear strategy, businesses often overcommit to products that do not justify the space, capital, or service level allocated to them. This leads to inventory accumulation that is difficult to reverse and costly to maintain.

A well-defined stocking strategy enables better overstock management, improves inventory turnover, and ensures that resources are allocated to the products that deliver the greatest return and profit.

Step 5: Take Control of Product Lifecycle Management

Effective overstock management requires a clear understanding of how products move through their lifecycle. Each phase presents unique inventory challenges and opportunities. Aligning your inventory strategy with these stages is essential to maintaining optimal stock levels and avoiding excess.

The Review Stage

Before introducing a new product, assess its strategic value to your assortment. Key questions include:

Will the product generate meaningful demand?

What does the market research suggest about ideal supply levels?

Do the projected margins justify its launch?

A thorough evaluation at this stage helps prevent unnecessary investment in low-performing items.

The Introduction Stage

Initial purchase decisions are critical. Consider:

How much stock should be ordered initially?

Which supplier offers the best balance of reliability, cost, and lead time?

A misstep here can lead to either stockouts or early overstock. Accurate demand forecasting and supplier selection are essential to achieving the right balance.

The Growth Stage

As demand increases, inventory must scale accordingly. Relying solely on qualitative insights or estimation is no longer sufficient. Transition to quantitative models that leverage historical data and predictive analytics to restocking decisions.

What are the projected demand increases?

How will these affect current stock levels?

Using data-driven (AI) forecasting ensures you maintain availability without overcommitting.

The Maturity Stage

Growth begins to stabilize, and demand may peak. Identifying this phase early is crucial.

Are forecasted sales beginning to diverge from actual performance?

Are service levels still appropriate?

Regular monitoring and fast adjustments help prevent overstock as demand decreases.

The Decline Stage

Demand begins to fall, often gradually but sometimes unexpectedly. Without proactive lifecycle management, excess inventory becomes inevitable.

Are you adjusting forecasts and service levels to reflect declining demand?

Are you actively managing the risk of maturation?

At this stage, you have access to the most comprehensive data. Use it to make informed decisions and minimize financial exposure.

Step 6: Rationalise Your Assortment

Effective assortment planning is a key component of overstock management. Rather than starting with the question of whether a product should be removed, a more strategic approach is to evaluate the justification for keeping it.

This shift in perspective simplifies decision-making and ensures that each item in your portfolio contributes meaningfully to business objectives. To support this evaluation, consider the following criteria:

Sales Frequency: How consistently does the product sell?

Revenue Contribution: What is the total revenue generated per item?

Profitability: How much of that revenue translates into profit?

Customer Reach: Is the product serving a broad customer base or a niche segment?

Substitutability: Can the product be replaced with an alternative that offers better performance or margin?

By applying these filters, you can identify underperforming items and streamline your assortment to focus on high-value, strategically important products. This not only reduces excess stock but also improves inventory turnover and operational efficiency.

Step 7: Challenge Poor Supplier Performance

Supplier reliability plays a critical role in inventory management. While external disruptions such as global events can understandably impact supply chains, not all supplier issues can be attributed to uncontrollable factors. Variability in performance across suppliers is common, and the consequences of poor supplier reliability can have a major impact on a business.

To mitigate the risk of excess stock caused by inconsistent supply, businesses must take a proactive approach to supplier evaluation and accountability. Before initiating corrective action, it is essential to establish a clear benchmarking framework.

Consider assessing suppliers against the following performance metrics:

Lead Time Accuracy: How consistently does the supplier meet promised delivery timelines?

Order Fulfillment Rate: What percentage of orders are delivered in full and on time?

Quality Compliance: Are products meeting the promised quality standards?

Responsiveness and Communication: How effectively does the supplier handle inquiries, changes, or disruptions?

Flexibility: Can the supplier adapt to changes in demand or urgent requirements?

Cost Stability: Are pricing structures predictable and aligned with market conditions?

By regularly evaluating supplier performance against these benchmarks, you can identify underperforming partners, initiate improvement discussions, and make informed decisions about future sourcing strategies. Strong supplier relationships are built on transparency, accountability, and mutual value. all of which are essential to maintaining inventory efficiency and avoiding excess stock.

On-Time-In-Full (OTIF) Rate

OTIF is one of the most widely used and effective KPIs in supplier performance management. It measures the percentage of orders delivered both on time and in full. If actual performance consistently falls short of expectations, it warrants a detailed review and discussion with the supplier.

Lead Time Variance

Even small deviations in lead time can have a significant impact on inventory planning and customer satisfaction. The difference between expected and actual delivery dates should be closely monitored. High variance may indicate systemic issues in the supplier’s operations or communication.

Before resorting to corrective action, consider the strategic importance of the supplier and the severity of the issue. If the supplier is critical to your operations and the problem is isolated, a constructive conversation may be more appropriate than drastic measures. The goal is to foster improvement while maintaining continuity and minimizing disruption.

Step 8: Clean Up Your Master Supplier Data

Accurate and up-to-date supplier data is essential for effective overstock management and strategic decision-making. Without reliable information across all business units, it becomes nearly impossible to assess supplier performance or make informed procurement decisions.

Recent global disruptions, like the tarifs, have affected suppliers in different ways. Some may still be operating under constraints, while others have resumed normal operations. To evaluate supplier capabilities effectively, consider the following:

Have any suppliers closed or scaled down production facilities?

Are they planning to return to standard operations, and if so, when?

What lead times are now typical, and how do they compare to pre-disruption benchmarks?

Information plus knowledge is power. Maintaining a clean, current supplier database enables better analysis, stronger negotiations, and more accurate forecasting. Ensure that systems are updated regularly and that data collection is embedded into your supply chain processes.

Step 9: Collaborate with Purpose

Collaboration across the supply chain is critical to preventing excess stock and improving responsiveness. The more visibility your suppliers have into your demand plans, the better they can support your inventory needs. Likewise, understanding your customers’ inventory requirements helps you avoid overproduction and misaligned stock levels.

Proactive information sharing reduces the risk of unexpected orders, irregular volumes, and unpredictable purchasing behavior. While identifying what data should be shared is straightforward, executing that collaboration requires commitment and structure.

With the right demand planning solution, collaboration becomes scalable, transparent, and performance-driven while simultaneously unlocking efficiencies across your entire supply chain.

Ready to take control of your inventory?

We’ve explained what excess stock really means. We’ve highlighted the risks of leaving it unchecked. And we’ve shared practical strategies to help you tackle the root causes of surplus inventory in your business.

Now it’s your turn to take action!

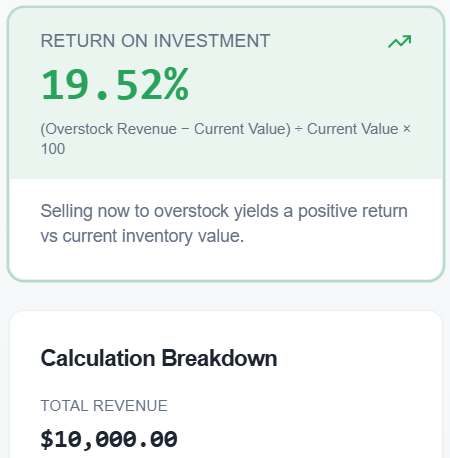

To support you in the fight against excess stock, we’ve condensed made a Overstock ROI Calculator to gain insights into profitibility.

Try the Calculator here